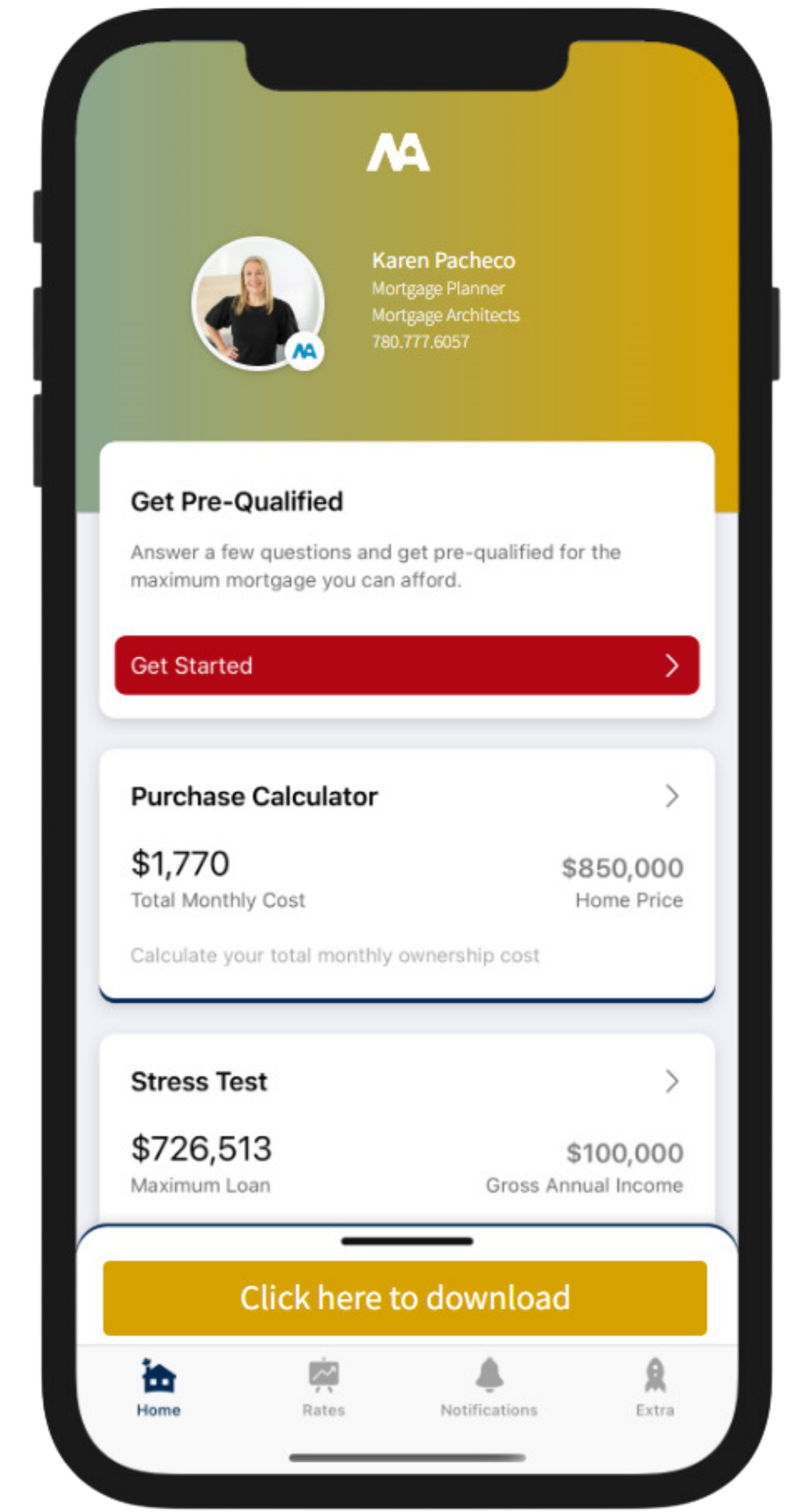

What I Can Help With

Mortgage Pre-Approvals

Your First Step!

Refinance

Unlock the potential of your home's equity!

Mortgage Renewal

Keep your mortgage on track with the best terms!

Investments Properties

Build wealth through real estate!

First-Time Home Buyers

Take the first step towards home ownership!

Don't See What You're Looking For?

I can probably still help!

The list above covers some common mortgage situations I assist with, but my expertise goes far beyond that. If you have specific mortgage-related questions that I didn't mention, still reach out—I’m here to help in any way I can!

What To Expect

Initial Discovery Call

During this call, we will explore your needs and wants as far as purchasing a new home or refinancing or renewing your existing home’s mortgage. I will review my process with you and ask questions regarding your employment, present and future financial goals, and give you an opportunity to ask questions.

Application Process

I will send you an online application along with a request for some documents which are specific to the needs established during our discovery call. I will also review any consent forms and send those to you for signing.

Pre-Approval

Once I have received your application, documents, and signed consent, I will compile a pre-approval with multiple scenarios such as:

- Refinance options with a variety of rates and terms

- Renewal options with a variety of rates and terms

- Purchase options with a variety of rates and terms along with different downpayment and purchase price options (application dependent)

Next Steps

At this point, if you are purchasing a home, you are ready to start shopping! You can communicate your pre-approval with your realtor or new home builder and make an offer on a home. For a refinance or a renewal, I will submit your application with supporting documents to the lender with the rate and term you selected from your pre-approval options.

Conditional Approval Received

Our goal is to receive a conditional approval from the lender. This is conditional as I still require the approval to be reviewed, accepted, and signed by you. I may need to request some additional documents from you to send to the lender to fully satisfy the conditions.

Conditions Satisfied

When the conditions have been satisfied, the mortgage is considered unconditionally approved. If there is a purchase involved, this is when you will be waiving any financing conditions that you inserted into the original purchase contract/offer to purchase. I will then issue the documents to your lawyer or notary (acting on behalf of a lawyer) and make arrangements for you to sign the mortgage instructions/final documents!

Possession/Funding Day

This is the exciting day when you will obtain possession of your home OR, the funds for your refinance OR, your new mortgage for your renewal will be activated! If purchasing, your realtor or new home builder will be provided notice of “Key Release,” which means that the lawyer has the funds for the mortgage and you can officially be given the keys to your home.

FAQs

What is Default Mortgage Insurance?

Default Mortgage Insurance is a type of insurance that protects the lender if a borrower defaults on their mortgage loan. It is typically required when the borrower makes a down payment of less than 20% of the home's purchase price, which is considered a higher-risk loan for the lender. In Canada, this insurance is mandatory for high-ratio mortgages (loans with a loan-to-value ratio of more than 80%) and is provided by institutions like Canada Mortgage and Housing Corporation (CMHC), Sagen (formerly Genworth), or Canada Guaranty.

What is the minimum downpayment required to purchase?

The minimum downpayment required to purchase a home depends on the home’s purchase price as well as if it is a home you are moving into or purchasing for investment. Here is how it works:

Homes $500,000 or less

Min downpayment is 5%

Homes between $500,000 and $1,499,999

Min downpayment is 5% on the first $500,000 and 10% on the portion above $500,000

Note: Some lenders have a sliding scale on the down payment calculation therefore it could work out to a higher amount depending on the purchase price and area the home is purchased in.

Homes $1,499,999 or more

Min downpayment is 20% of the purchase price – No default mortgage insurance is available for homes that exceed $1,499,999

Rental Properties

Typically require at least 20% however this could vary from lender to lender

Second Home or Vacation Property

In some cases, you may be able to purchase a 2nd home or vacation property with less than 20% based on the above guidelines. This varies from lender to lender and cannot be used as a rental property.

Can I use gifted funds as downpayment?

Yes, you can use gifted funds for a down payment on a home, however there are specific rules and requirements you need to follow.

Eligible Sources:

Gifted funds must come from an immediate family member (e.g., parents, grandparents, siblings). Some lenders may allow gifts from other relatives or close connections, but this depends on their policies.

Gift Letter

A signed gift letter may be required which would include the information of the giftor, the amount of the gift, that the gift does not need to be repaid. In some cases, the lender would then need the gift letter signed and stamped by the giftor’s branch.

Proof of Transfer:

The funds must be in your bank account before closing and lenders will often require proof such as an updated statement showing the deposit.

What is a fixed-rate mortgage?

A fixed-rate mortgage is a type of home loan where the interest rate remains constant for the entire term of the mortgage. This means your monthly payments for principal and interest stay the same, offering stability and predictability.

What is a variable-rate mortgage?

A variable-rate mortgage is a home loan where the interest rate can change over time, as it is tied to the lender's prime rate, which fluctuates based on the Bank of Canada's rate changes. This means your payments or the portion applied to the principal and interest can vary during the term.

How much can I afford to borrow for a mortgage?

This depends on your income, debts, credit score, and the size of your down payment. Lenders use two key ratios to determine affordability:

- Gross Debt Service (GDS): Should be no more than 35% of your income.

- Total Debt Service (TDS): Should be no more than 42% of your income.

What documents do I need to apply for a mortgage?

There are an array of documents which vary from file to file. The general ones needed are:

- Application - Completion of my mortgage application and acceptance of my consent forms

- Proof of income – This can vary however generally you will need a letter of employment, pay stubs, T4 Slips. You could also be asked for 2 years of tax returns and Notice of Assessments (NOAs)

- Proof of downpayment – This can also vary depending on the application however generally we would require a 90 day history from any account(s) that the downpayment has been saved in. Programs involving gifted downpayment, gifted equity, and borrowed downpayment would require different documents

- ID – Government Issued ID

What is the amortization period?

The length of time it takes to pay off the entire mortgage, typically 25 years for insured mortgages. Uninsured mortgages may allow up to 30 years.

Can I include renovations into my mortgage?

Yes, with the Purchase Plus Improvements program, you can add renovation costs to your mortgage. There are stipulations with this such as upfront quotes, downpayment increased to the improved value, as well as the types of things that can be added into the mortgage as part of the renovation.

What happens if I am self-employed?

You may need to provide additional proof of income, like business financials, Notice of Assessments (NOA), Tax Returns (T1 Generals) and/or business bank statements to show consistent earnings.

What additional costs should I budget for?

On top of your downpayment, you will need to account for closing costs: Approximately 1%-4% of the purchase price, including:

- Legal fees and title insurance

- Home inspection and appraisal fees

- Land transfer tax (varies by province)

A fresh perspective on mortgages!

Ready to unlock the best mortgage solutions tailored to your needs? Let’s work together to find the perfect fit for your financial goals and get you on the path to homeownership with confidence. Reach out today and make your dream home a reality!